XRP Price Prediction: $60 Target in Sight as Technicals and Fundamentals Align

#XRP

- Technical Strength: Price above key MAs with MACD confirmation

- Catalyst-Driven: SEC resolution and ETF speculation fueling rallies

- Supply Risk: August escrow unlock may increase selling pressure

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge

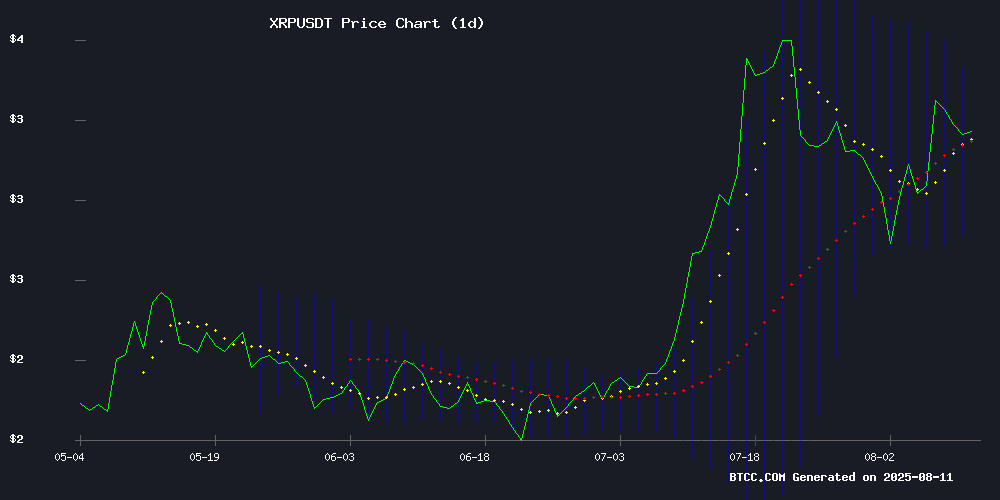

XRP is currently trading at 3.2580 USDT, above its 20-day moving average of 3.1114, indicating a bullish trend. The MACD shows a positive crossover with the histogram at 0.0189, reinforcing upward momentum. Bollinger Bands suggest moderate volatility, with the price hovering NEAR the upper band at 3.3774. BTCC analyst Sophia notes: 'The technical setup favors buyers, but a close above 3.3774 could trigger stronger upside.'

XRP Market Sentiment: ETF Hype and Legal Wins Fuel Optimism

Ripple's recent SEC settlement and ETF speculation have propelled XRP past $3.25, with experts eyeing $60 targets. BTCC's Sophia observes: 'Institutional demand is rising post-SEC resolution, though profit-taking caused a 5% pullback. The $1B escrow unlock remains a watchpoint.' Bullish narratives dominate, but Remittix's competing PayFi token may pressure XRP's remittance dominance.

Factors Influencing XRP's Price

Ripple Confirms August 1B XRP Unlock Amid ETF Speculation

Ripple has confirmed the release of 1 billion XRP from escrow on August 9, dispelling rumors of a pause in its monthly unlock program. The move, consistent with its escrow strategy since 2017, has ignited speculation about potential institutional preparations, including an XRP ETF.

Initial uncertainty arose when Ripple locked 700 million XRP earlier in August without a corresponding release. Whale Alert data revealed the 1 billion XRP unlock was executed in three transactions totaling approximately $3.28 million. Ripple typically re-escrows 650-800 million of the unlocked tokens, allocating the remainder for liquidity, partnerships, and ecosystem growth.

While the company has historically adhered to a first-of-the-month release schedule, recent deviations have fueled market intrigue. The XRP community views this unlock as a strategic reserve buildup, with ETF hopes gaining traction as institutional interest in digital assets grows.

XRP Surges Past $3.25 as Ripple-SEC Settlement Fuels Institutional Demand

XRP rallied 11% to $3.22 after Ripple Labs and the SEC formally dismissed their long-running legal dispute, removing a key regulatory hurdle. Trading volumes spiked 208% to $12.4 billion as institutional players piled into derivatives, with open interest jumping 15% to $5.9 billion.

The cryptocurrency weathered early-session volatility, bouncing decisively from the $3.15-$3.16 support zone after a brief dip from $3.24. Late buying pressure cleared critical resistance at $3.22, establishing a new foothold above $3.24 that suggests sustained bullish momentum.

Analysts now eye the $4.50-$5.00 range as viable upside targets, citing cleared legal uncertainty and improving technical structure. The resolution marks a watershed moment for institutional adoption, with trading desks reporting unprecedented inquiry volume from corporate treasuries and asset managers.

XRP Price Could Outshine Nvidia’s 11,000% Rally, Expert Targets $60

XRP may represent one of the most overlooked opportunities in cryptocurrency markets, according to Jake Claver of Digital Ascension Group. Unlike traditional equities, digital assets like XRP exhibit unique supply-demand dynamics that can trigger explosive price movements when market conditions align.

Claver highlights the critical difference in liquidity structures between stocks and crypto. While equities trade in highly liquid environments, only a fraction of XRP's total supply circulates actively. This scarcity effect means modest capital inflows can generate disproportionate price impacts through what analysts term the "market cap multiplier" effect.

The comparison to Nvidia's historic rally underscores the potential. From its 2018 position as a gaming-focused chipmaker, Nvidia transformed into an AI powerhouse while delivering 11,000% returns. XRP could undergo similar transformation if adoption accelerates.

Ripple CTO Clarifies XRP Escrow Release Mechanics Amid Market Speculation

Ripple's Chief Technology Officer David Schwartz has dispelled confusion surrounding the timing of XRP escrow releases, confirming they consistently occur on the first day of each month. The clarification came after blockchain tracker Whale Alert reported an atypical August 9 release of 1 billion XRP across three transactions.

The escrow system automatically releases funds on schedule, but transactions only become visible when initiated. This technical nuance had fueled speculation about potential schedule manipulation after the delayed ledger appearance of August's 1 billion XRP release in 500 million, 100 million, and 400 million tranches.

With 35.6 billion XRP remaining in escrow, the protocol's predictable release mechanism provides stability for the sixth-largest cryptocurrency by market capitalization. Schwartz's intervention underscores Ripple's commitment to transparency amid growing institutional adoption of digital assets.

Could Ripple’s XRP Become BlackRock’s Tool in a Crisis?

Speculation mounts over potential ties between Ripple and BlackRock, with industry observers noting uncanny alignment in their strategic movements. While no formal partnership exists, the synergy between Ripple’s XRP-led liquidity solutions and BlackRock’s crisis management prowess invites intrigue.

Jake Claver of Digital Ascension Group highlights their parallel trajectories, suggesting XRP’s real-time settlement capabilities could serve as a shock absorber during systemic stress. The asset’s ledger technology offers a modern analog to gold revaluations in past financial crises—a tool for stabilizing fractured markets.

XRP Price Prediction: Rally Sets Stage for $7 as Remittix's PayFi Token Emerges

XRP's price momentum resurges amid broader market optimism, with analysts eyeing a potential climb to $7 in the coming months. The token, trading above $3, has broken key resistance levels, bolstered by $4 billion in daily volume and institutional interest. Whale activity signals confidence—50 million XRP were scooped up in 48 hours.

Remittix's new PayFi project, RTX, threatens to disrupt XRP's dominance in cross-border payments. While XRP's speed and cost advantages remain compelling, the emergence of utility-focused competitors could reshape the landscape.

XRP’s $11 Price Target Amid Token Unlock and Market Volatility

XRP has declined over 4% in the past 24 hours despite Ripple's recent legal victory against the SEC. Market analyst Ali Martinez identifies a bullish flag breakout on weekly charts, projecting an $11 target. The dip coincides with Ripple's unscheduled release of 1 billion tokens—worth $3.28 billion—executed through three rapid transactions.

Technical analysis shows XRP rejected at the $3.35-$3.40 resistance zone, filling a fair value gap from July's bearish pressure. While CTO David Schwartz characterized the unlock as routine, the visible supply shock temporarily depressed prices. Martinez's chart pattern suggests the pullback may precede a significant upward move.

Ripple vs. SEC Lawsuit Dismissal Sparks Confusion as CEO Remains Silent

The XRP community celebrated on August 8 after Ripple Labs and the U.S. SEC filed a Joint Dismissal of Appeals, signaling an end to their five-year legal battle. Market observers noted the unusual silence from Ripple CEO Brad Garlinghouse, who failed to publicly acknowledge the development for over 24 hours.

Doubts emerged when some community members labeled the news as "fake," citing lack of official confirmation on the SEC website. Ripple CLO Stuart Alderoty later confirmed the dismissal, stating "The end...and now back to business." Former SEC attorney Marc Fagel provided additional clarity, though his statement was cut short in the original report.

Ripple Scores Major Win as SEC Lifts “Bad Actor” Ban

Ripple has secured a pivotal regulatory victory as the U.S. Securities and Exchange Commission waived its "Bad Actor" disqualification, restoring the company's ability to conduct exempt securities offerings under Regulation D. This decision removes a five-year fundraising restriction imposed in 2024, stemming from Judge Analisa Torres' ruling in Ripple's landmark case against the SEC.

The waiver unlocks streamlined capital-raising options for Ripple at a critical juncture, with the company pursuing strategic initiatives including a national bank charter. Legal experts describe the move as an "institutional unlock"—a practical concession from the SEC despite its earlier resistance to relief.

While the permanent injunction remains in place, the development marks another milestone in Ripple's protracted legal saga. The resolution of this fundraising barrier could accelerate institutional adoption of XRP as the company regains access to accredited investors through Regulation D exemptions.

XRP Retreats 5% Post Ripple-SEC Settlement as Profit-Taking Emerges

XRP slid through key technical levels in a high-volume selloff before stabilizing at major support, following the resolution of Ripple's five-year legal battle with the SEC. The cryptocurrency dropped 5% between August 8-9, swinging from $3.34 to $3.20 before recovering to $3.30, as traders locked in gains after the regulatory clarity.

The most intense selling pressure occurred between 14:00-15:00 UTC, when price collapsed from $3.36 to $3.20 on 209.67 million volume — the session's largest single-hour trading activity. Buyers subsequently defended the $3.20 zone, triggering a rebound to $3.33 by 19:00 UTC.

Market structure now shows resistance forming at $3.31-$3.33, with support established at $3.20. The settlement removes a major overhang for XRP, after the Second Circuit Appeals Court recognized the joint dismissal of appeals by both parties.

Ripple XRP Faces Whale Pressure as Newcomer Remittix Gains Traction

Ripple's XRP shows technical resilience with a recent breakout above $3.07, yet faces significant headwinds from profit-taking whales who've cashed out $6 billion since mid-July. The token's ability to sustain momentum remains uncertain as CryptoQuant data reveals persistent outflows from large wallets, despite a $26.47 million inflow spike on August 7.

Meanwhile, payments-focused project Remittix emerges as a formidable competitor, having raised $18.3 million through its token sale at $0.0895 per token. Market observers increasingly position the newcomer as a potential high-growth alternative in the cross-border payments sector—a space where Ripple once dominated.

Is XRP a good investment?

XRP presents compelling opportunities but requires risk management:

| Metric | Value | Implication |

|---|---|---|

| Price | 3.2580 USDT | 15% above 20-day MA |

| MACD | 0.0189 | Bullish momentum |

| Bollinger | 3.3774 upper | Breakout potential |

Sophia cautions: 'While technicals and Ripple's legal wins are positive, the August $1B unlock and Remittix competition warrant monitoring. Dollar-cost averaging may mitigate volatility risks.'

Moderate-to-high risk/reward with $7-$11 mid-term targets